Strategy Toolboxes

Robust Proofs of Concept, Toolboxes & Strategy Drafts

Fundamental & Technical Portfolio of Robust Proof of Concept Strategies for Futures & Commodities

The trading systems below are proofs of concept and drafts to demonstrate extremely robust market concepts you can use to develop your own strategies with.

All market concepts demonstrated in the toolbox are universal, apply to many instruments, and demonstrate underlying fundamental concepts that are being used for live, real money speculative trading in several commercial banks, asset management companies, major consultancies, and hedge funds.

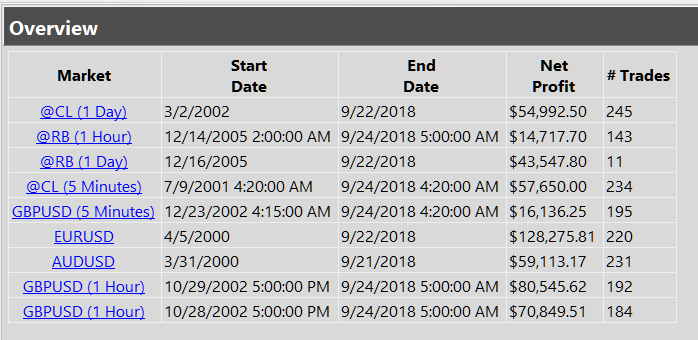

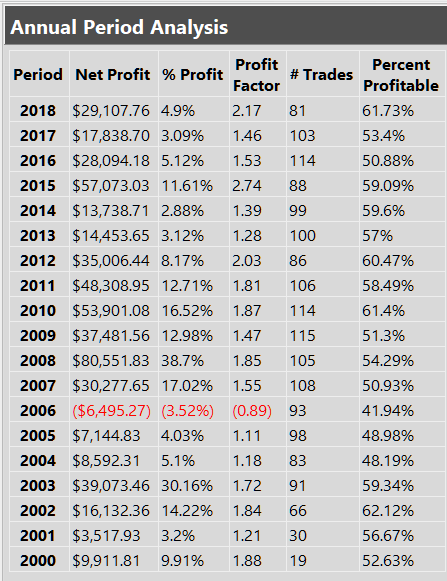

All backtests below are rendered according to the following parameters:

- No position sizing, just trading 1 lot. Even 1% fixed fractional inflates numbers significantly due to the compounding effect. The numbers here are not inflated in any way. There are no marketing gimmicks in the tests below.

- No Take Profit / StopLoss, or anything else that distorts true performance

- No Walk-Forward Optimization deployed in any strategies

- Only time based & "Signal" / Strategy exits, no "tricky" trailing stops or other potential curve fitting risks

- Where optimization was performed, the optimization space was a maximum of 1000 variations on over 100,000 data points, with at least 30,000 data points Out of Sample. Most optimization spaces are significantly smaller.

- The backtests show net return on the underlying asset by trading 1 contract / 1 lot.

- Transaction costs: 2 * average spread and slippage for currencies, $25 round trip slippage + $6.25 / contract commission for commodities.

- For more details, please contact us at contact@algosciences.com

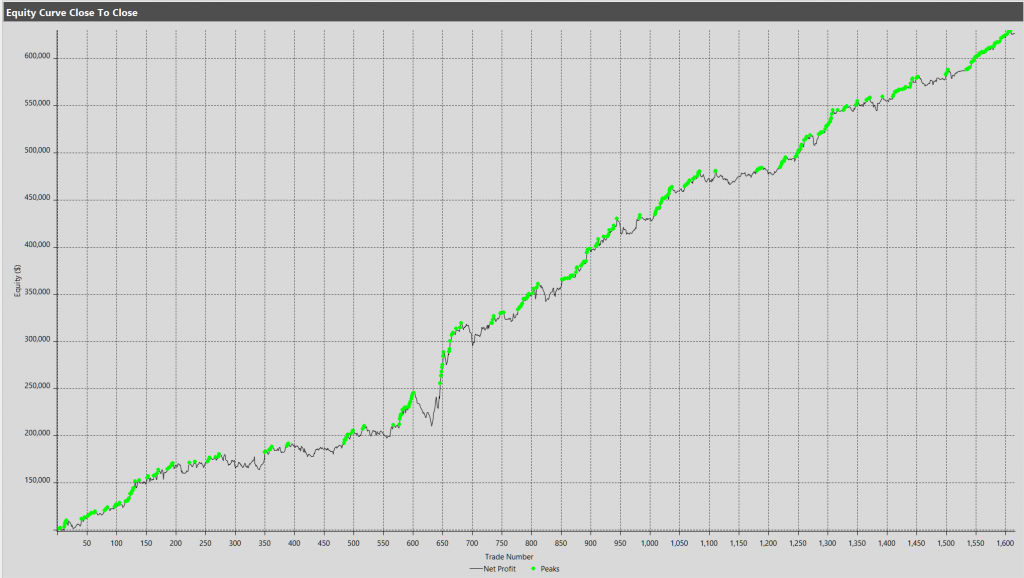

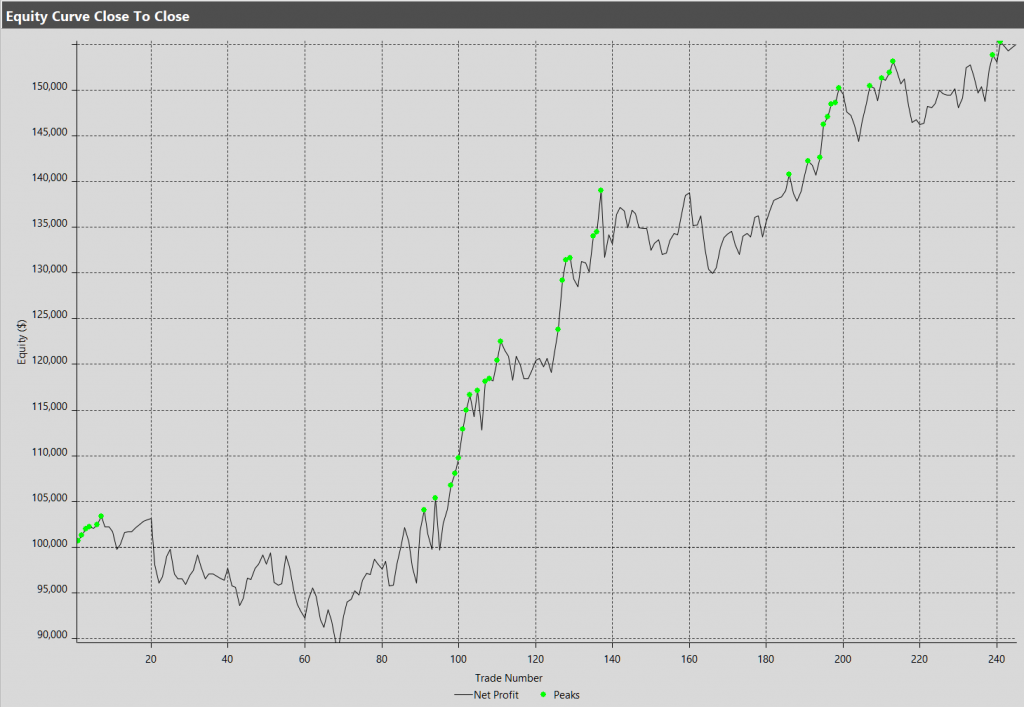

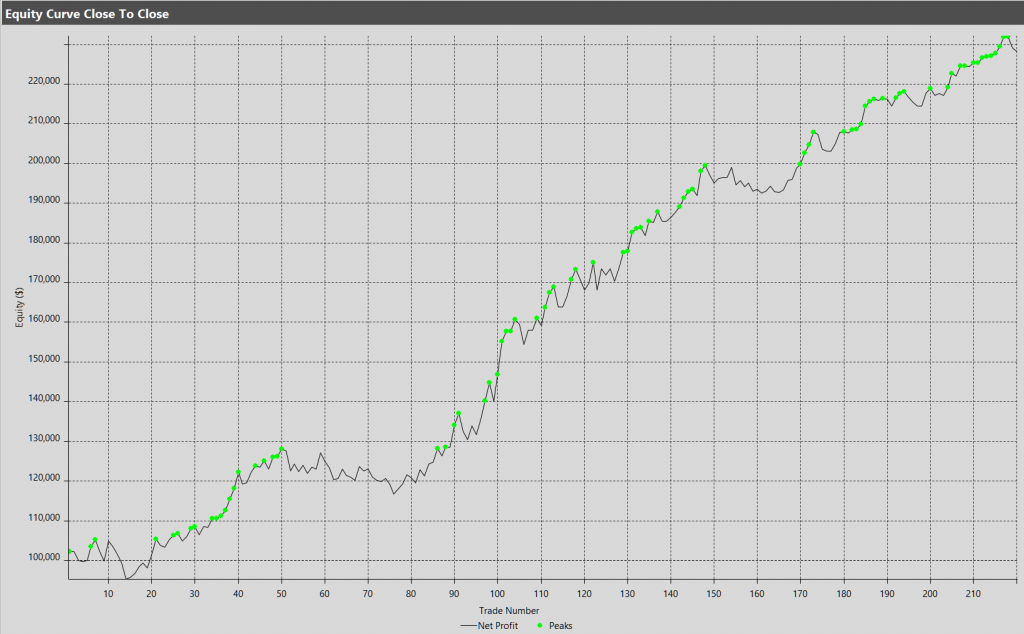

Equity line for all proof of concept systems combined

100% Out of Sample performance since 2015:

Trading systems’ individual performances:

Crude Oil (@CL) strategy for Daily Timeframe

Strategy based on simple seasonality patterns. Similar patterns work universally among many instruments.

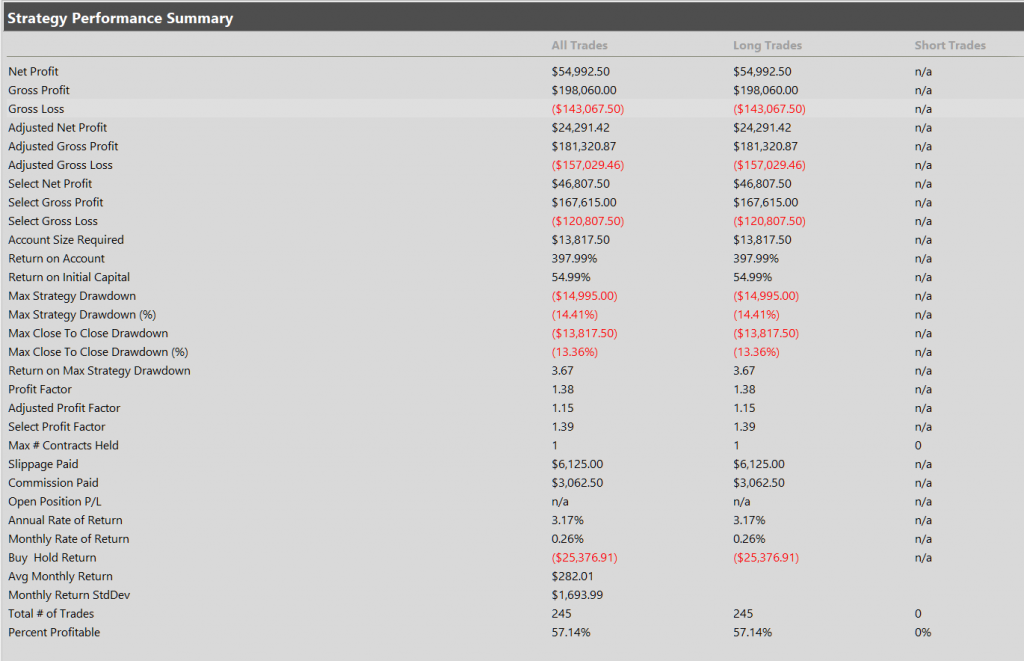

RBOB Gasoline (@RB) strategy for Daily Timeframe

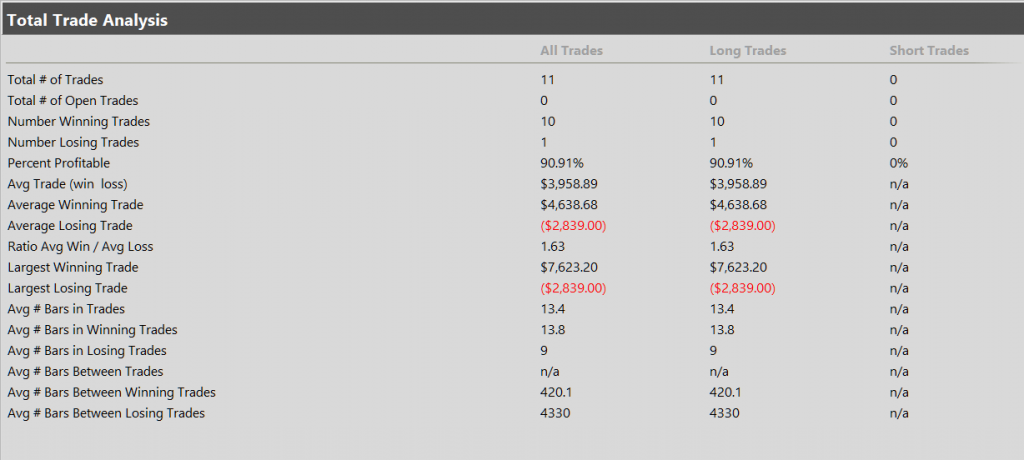

Strategy with FUNDAMENTAL basis – this is the “original” mentioned previously. It is based on the economic behavior of market participants during a specific time of the year. It basically makes one big trade every year with a very high hit rate.

The strategy is 100% OOS since 2010 and is traded by major hedge funds, consulting companies and central banks around the world.

EURUSD “LTC” strategy for Daily Timeframe

Strategy with a universal, fundamental principle (AUDUSD below is the same strategy with very slight modification on filter and one parameter)

OOS since 2014

Comes with detailed comments, explanation and a scientific paper that the strategy is based on.

Also comes with a special indicator that helps you adapt this for shorter time frames and use in other intraday & longer term systems as a very efficient filter.

AUDUSD “LTC” strategy for Daily Timeframe

Similar to EURUSD with some slight adaptation and modification for the asset.

OOS since 2015

Comes with detailed comments, explanation and a scientific paper that the strategy is based on.

Also comes with a special indicator that helps you adapt this for shorter time frames and use in other intraday & longer term systems as a very efficient filter.

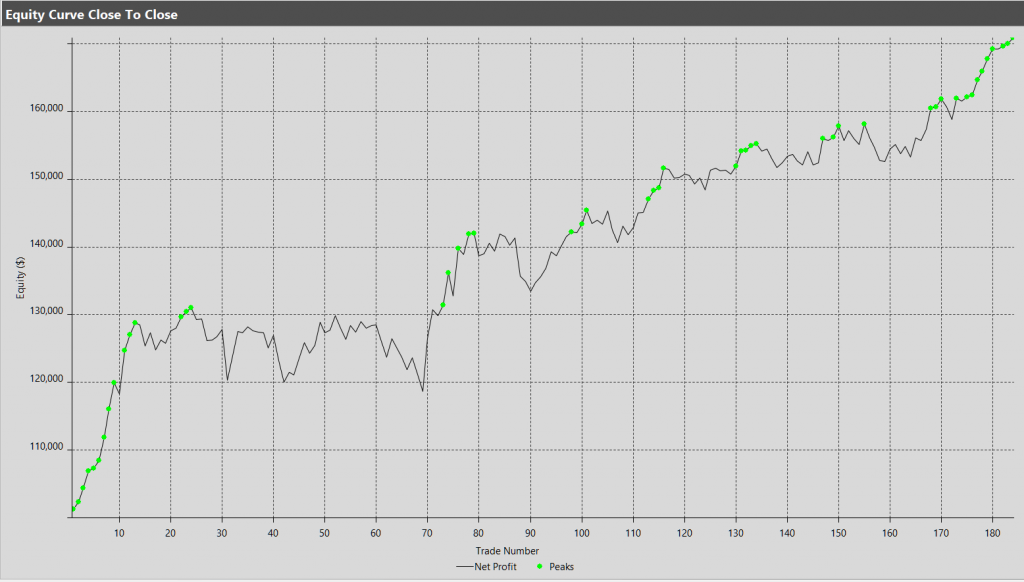

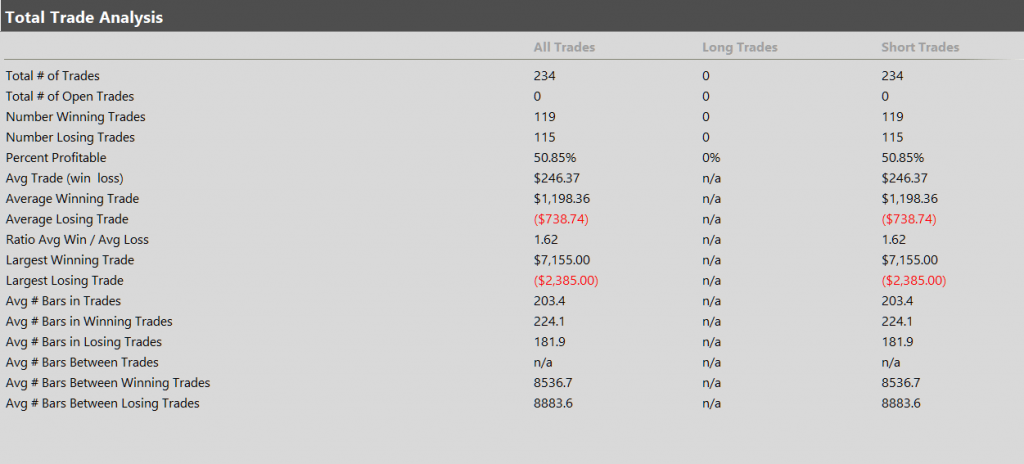

GBPUSD “LTC” strategy for 1-Hour Timeframe

Similar to EURUSD with some slight adaptation and modification for the asset. This strategy was created to demonstrate the universal principle is also present on the 1 Hour timeframe.

OOS since 2014

Comes with detailed comments, explanation and a scientific paper that the strategy is based on.

Also comes with a special indicator that helps you adapt this for shorter time frames and use in other intraday & longer term systems as a very efficient filter.

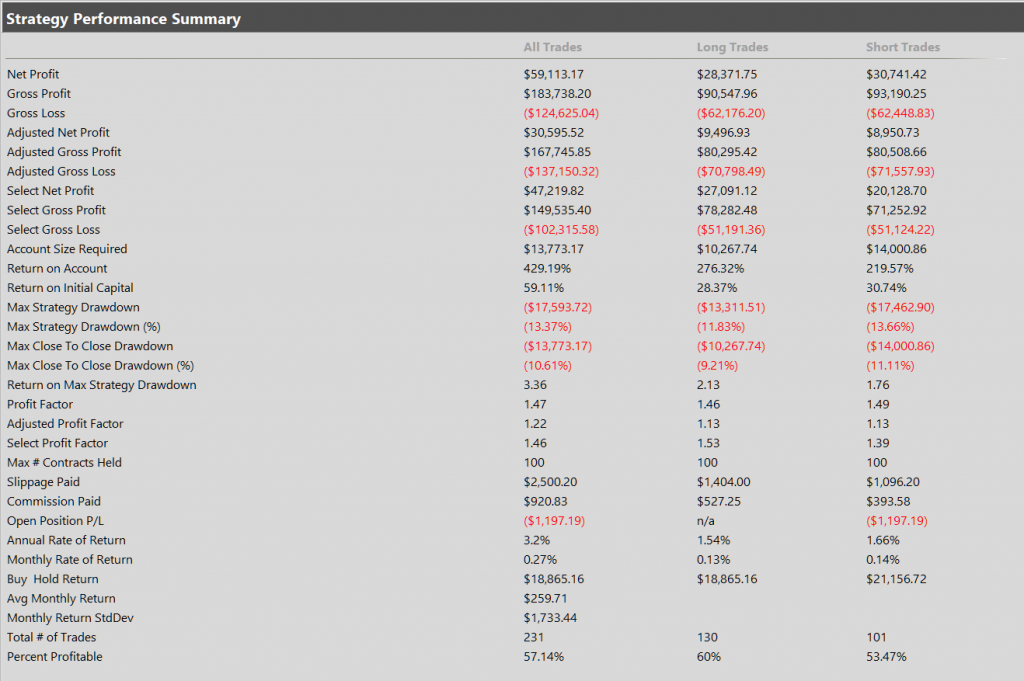

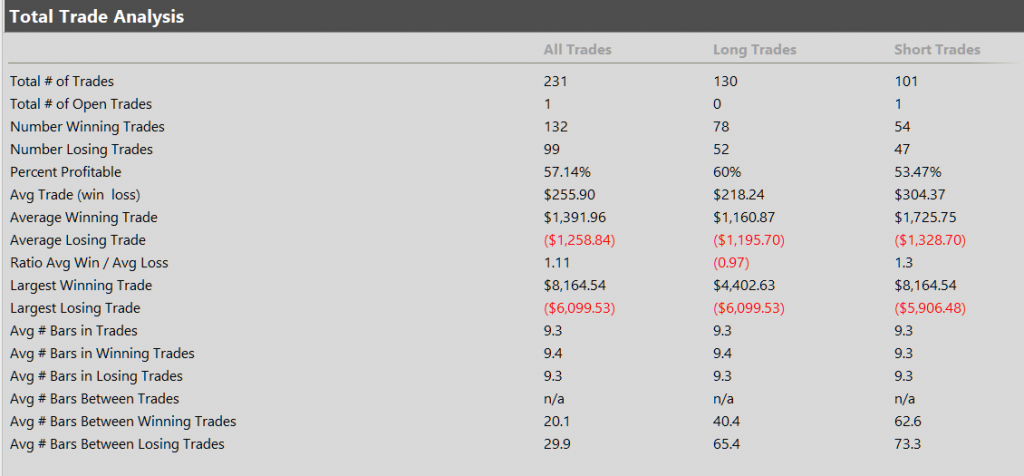

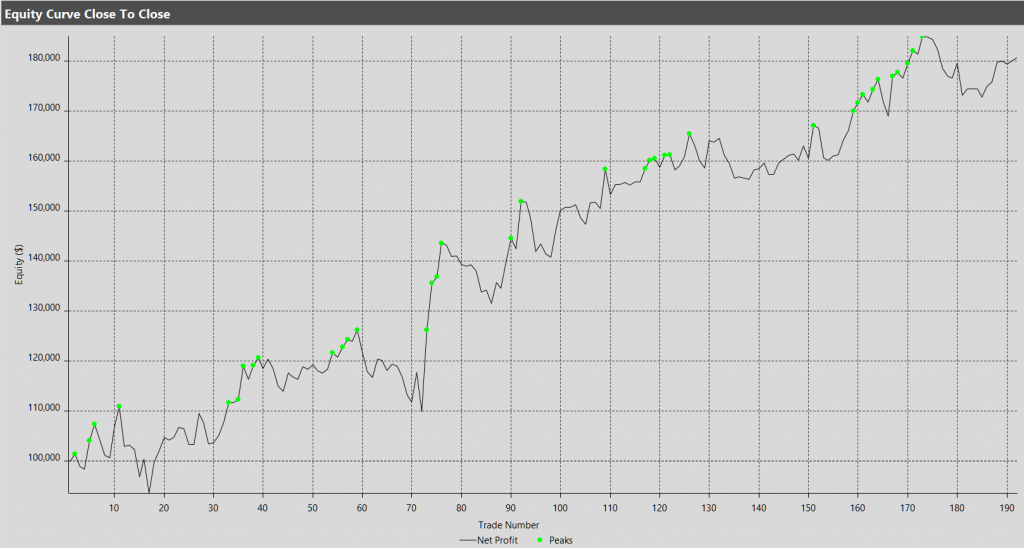

The long & short side of the strategy are negatively correlated with some overlapping trades, so the backtests are shown separately below.

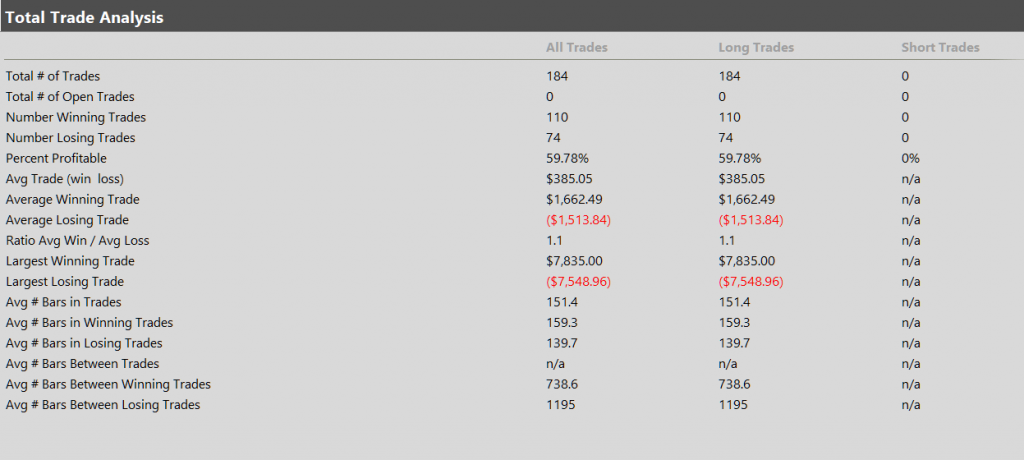

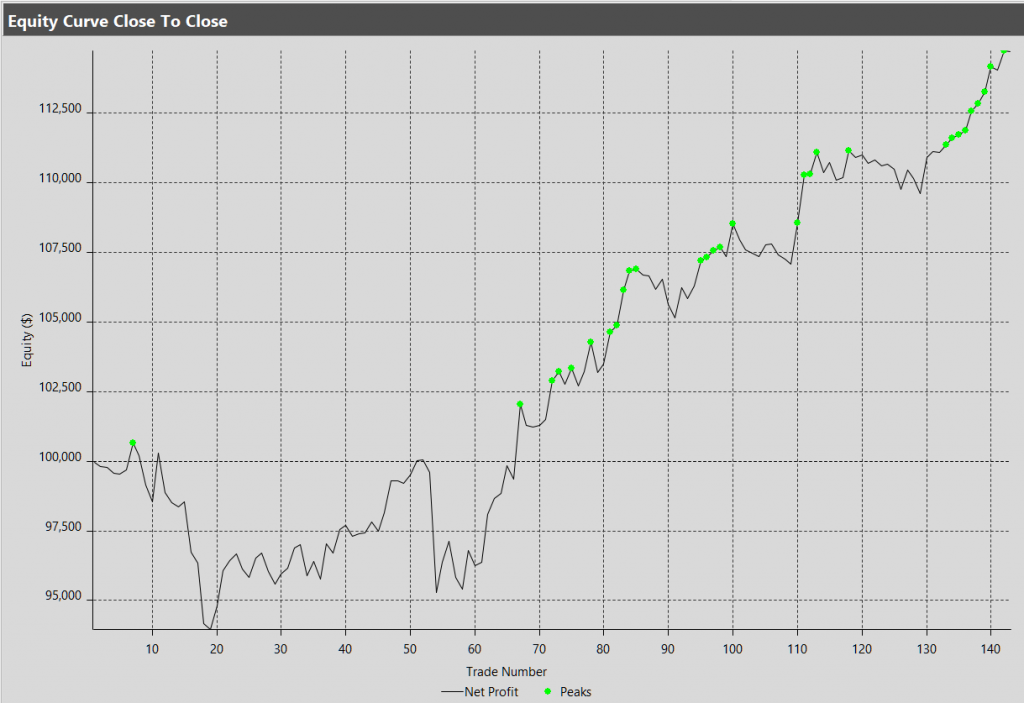

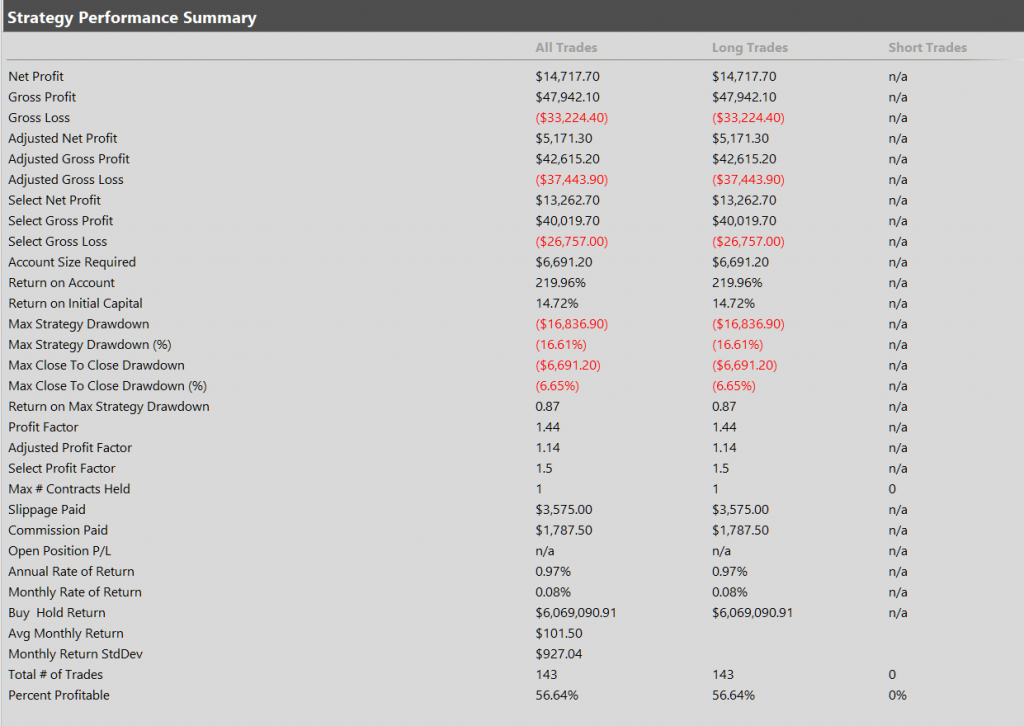

LONG SIDE

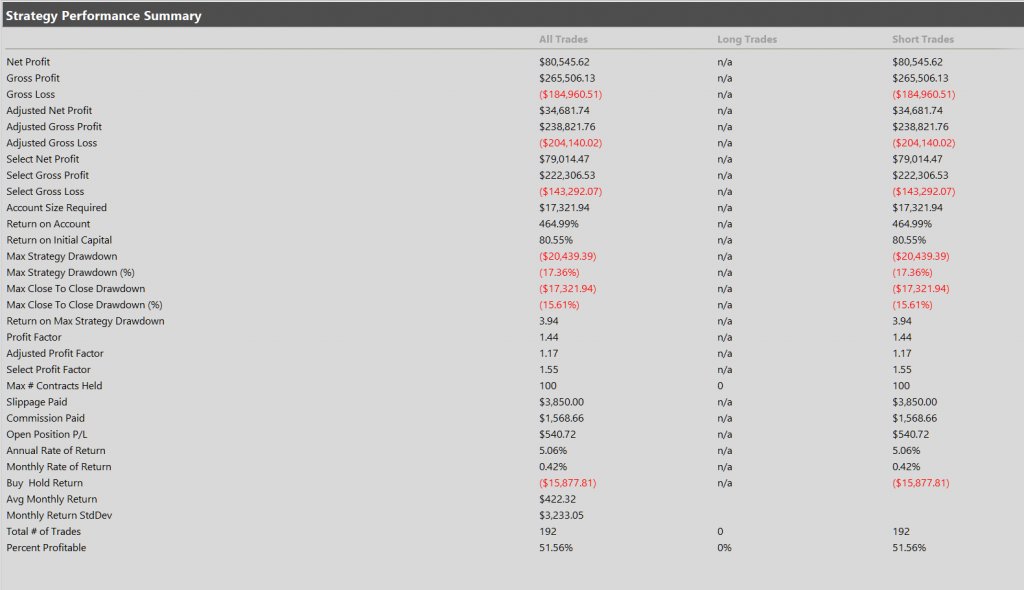

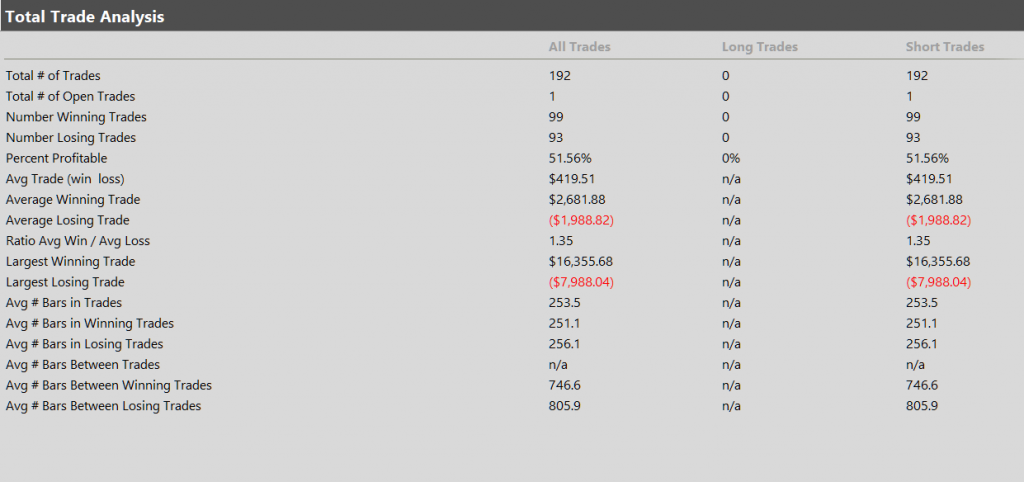

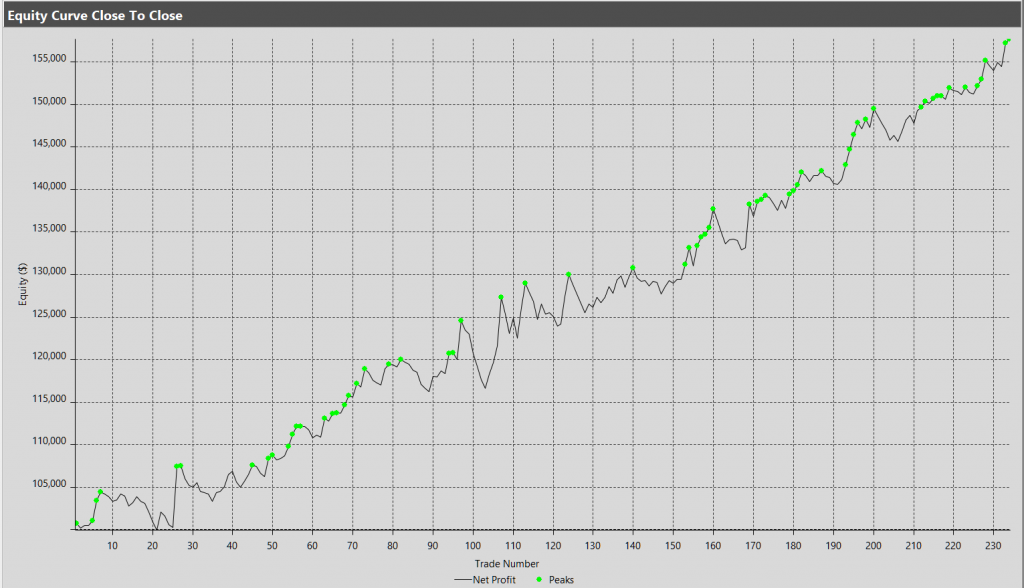

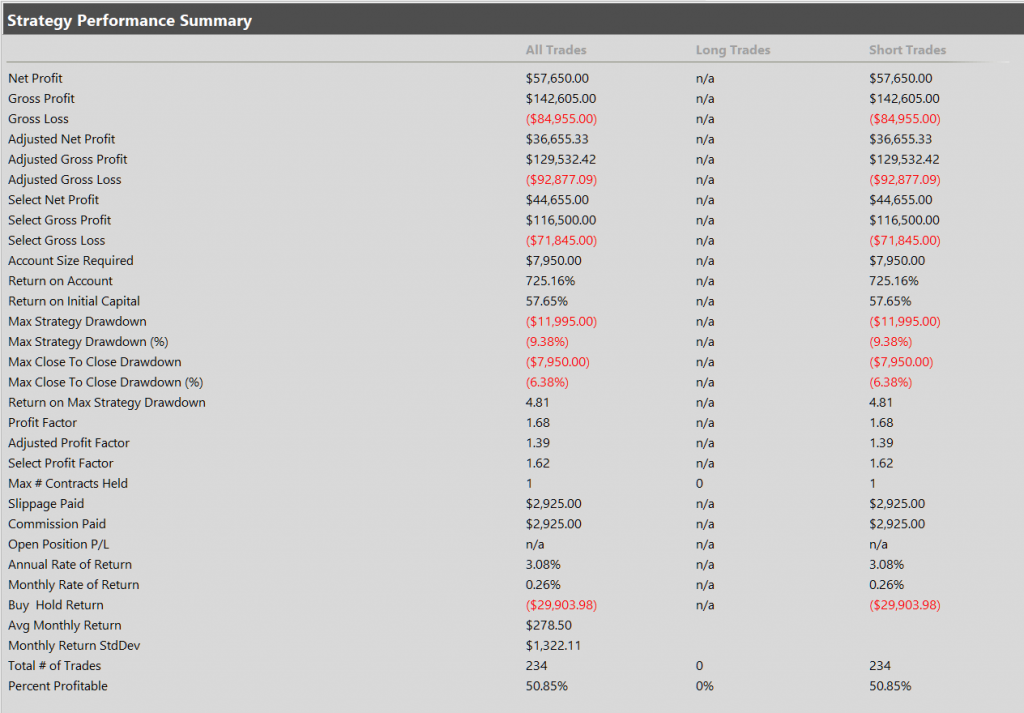

SHORT SIDE

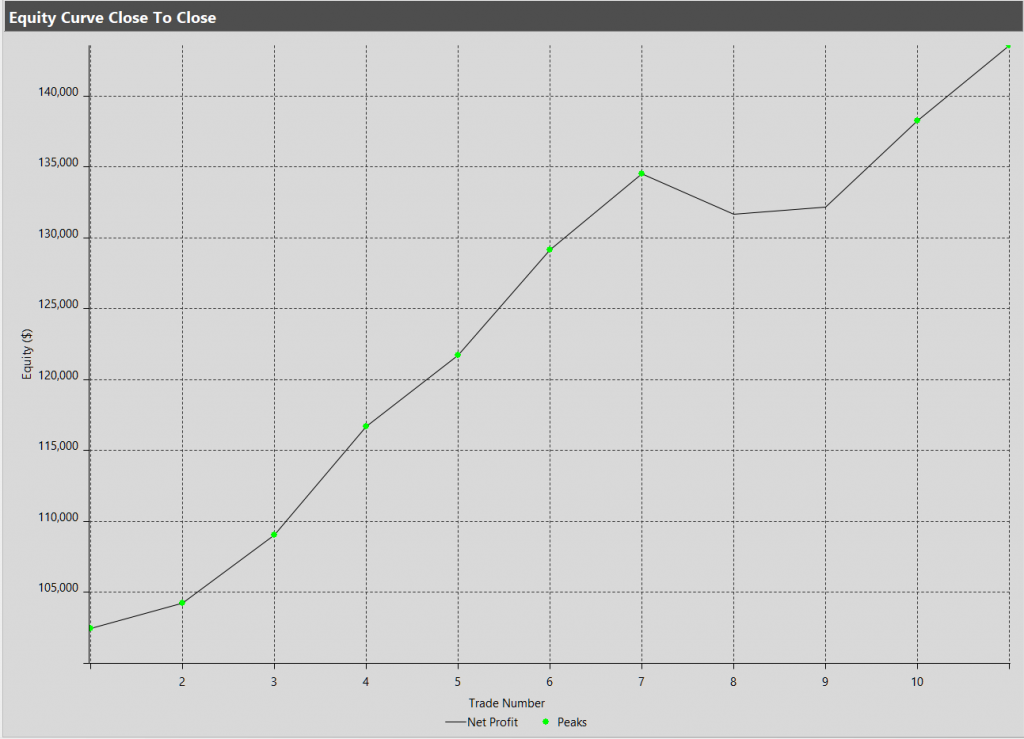

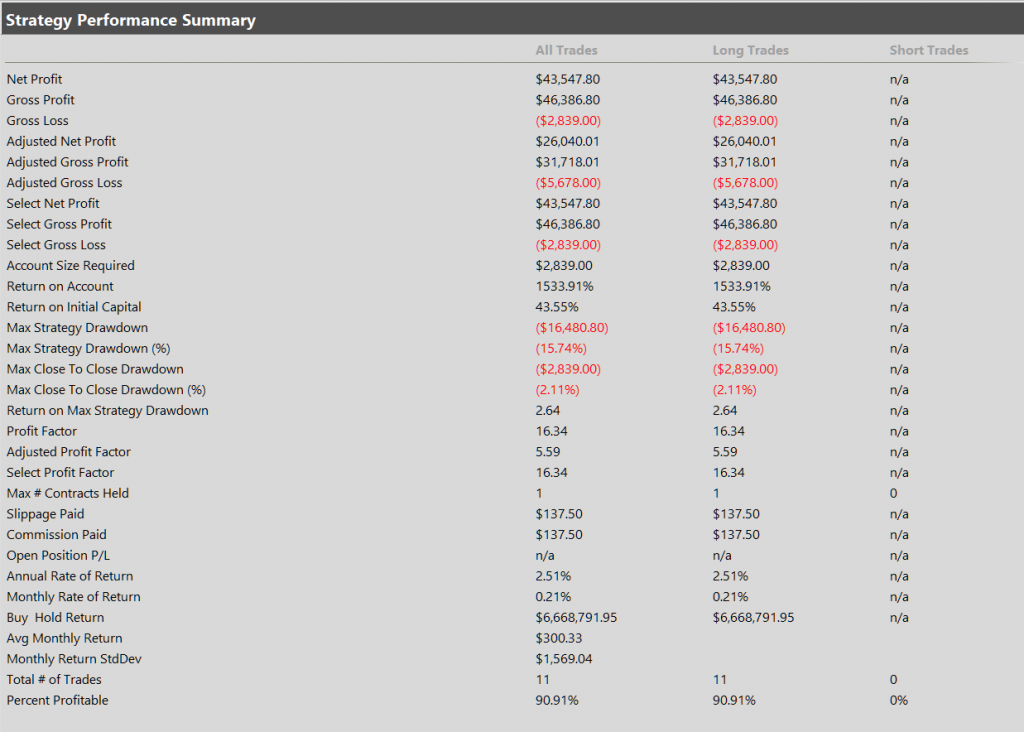

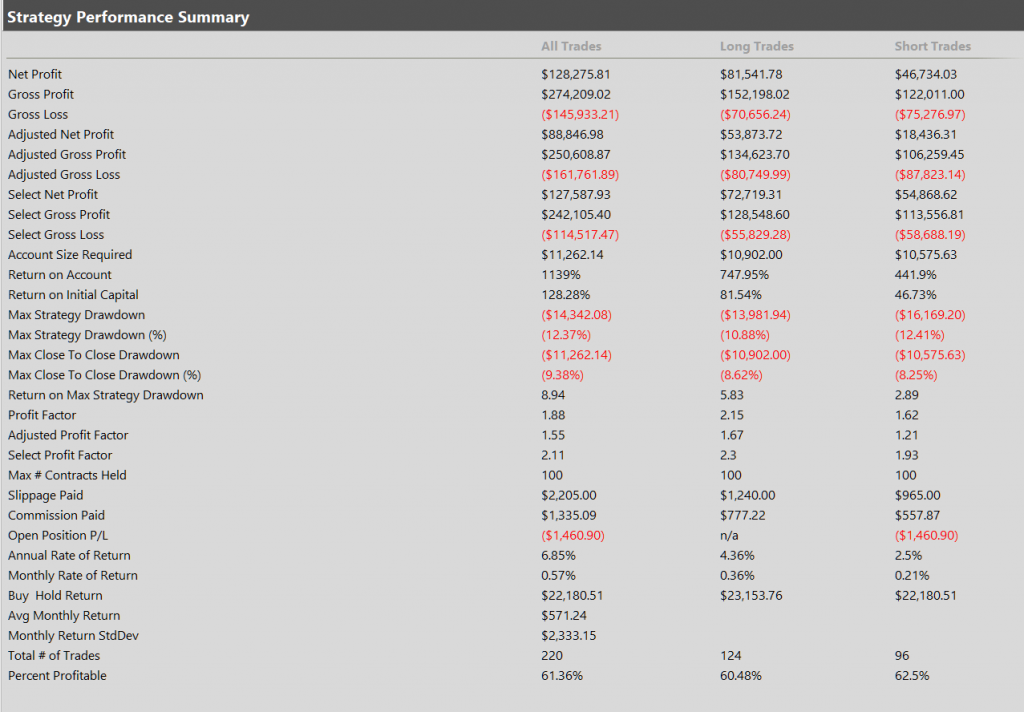

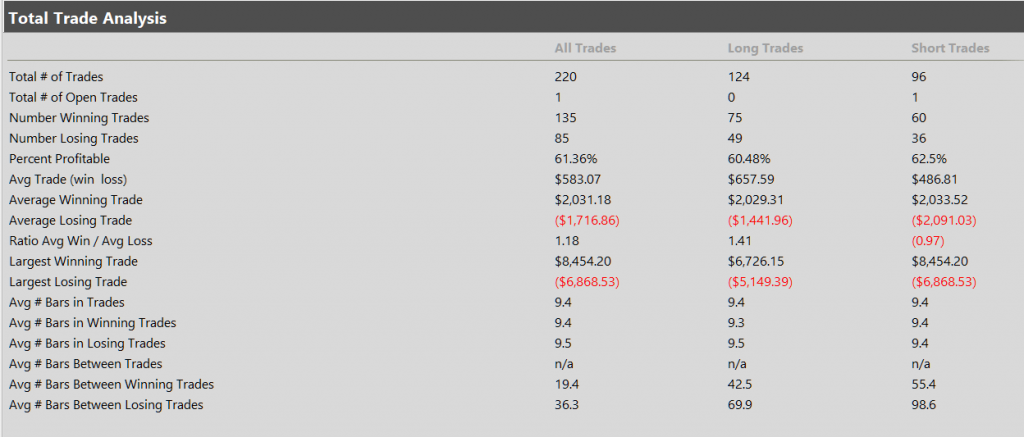

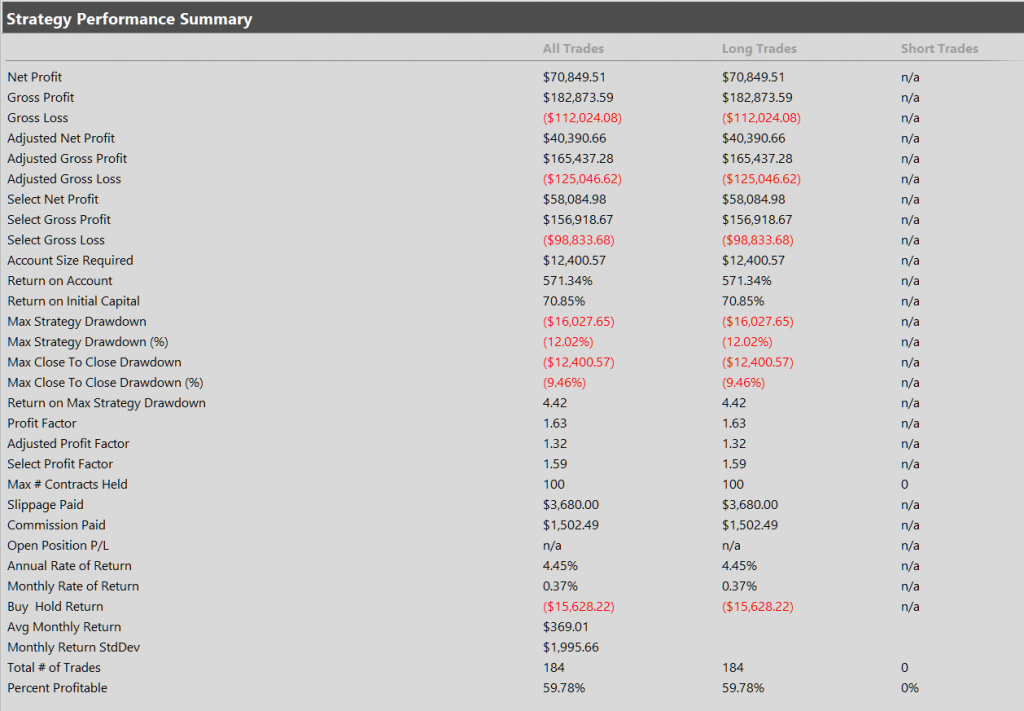

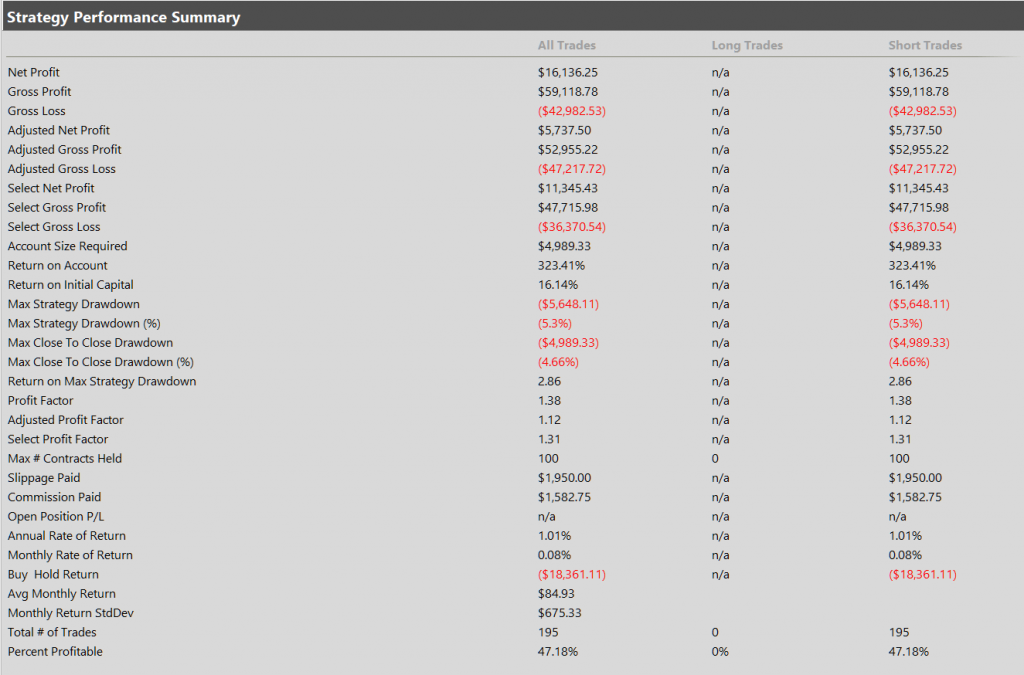

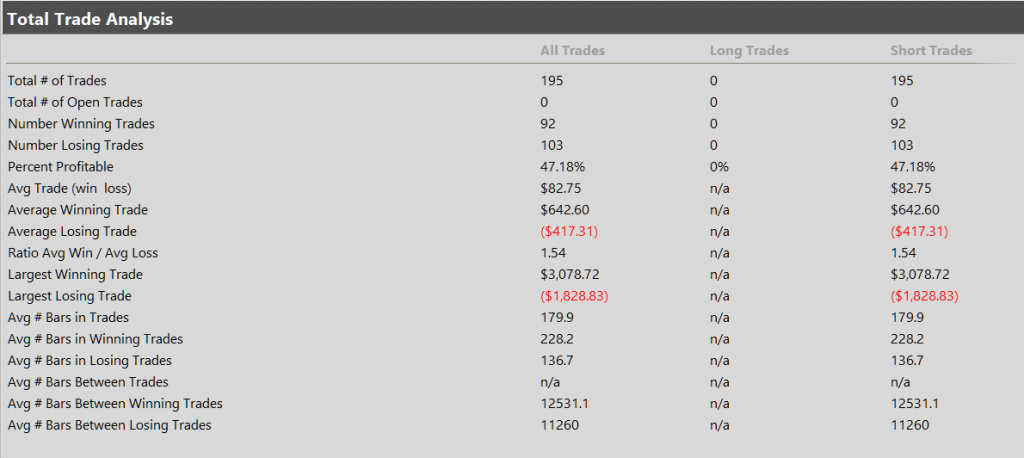

RBOB Gasoline (@RB) for 1-Hour Timeframe

Strategy with FUNDAMENTAL basis. It is based on the economic behavior of market participants during a specific time of the year.

The original is based on the daily timeframe (see above). This is broken down onto the hourly time frame for compounding purposes, with shortened hold times. The 2 strategies are 60% correlated when calculated based on monthly equity.

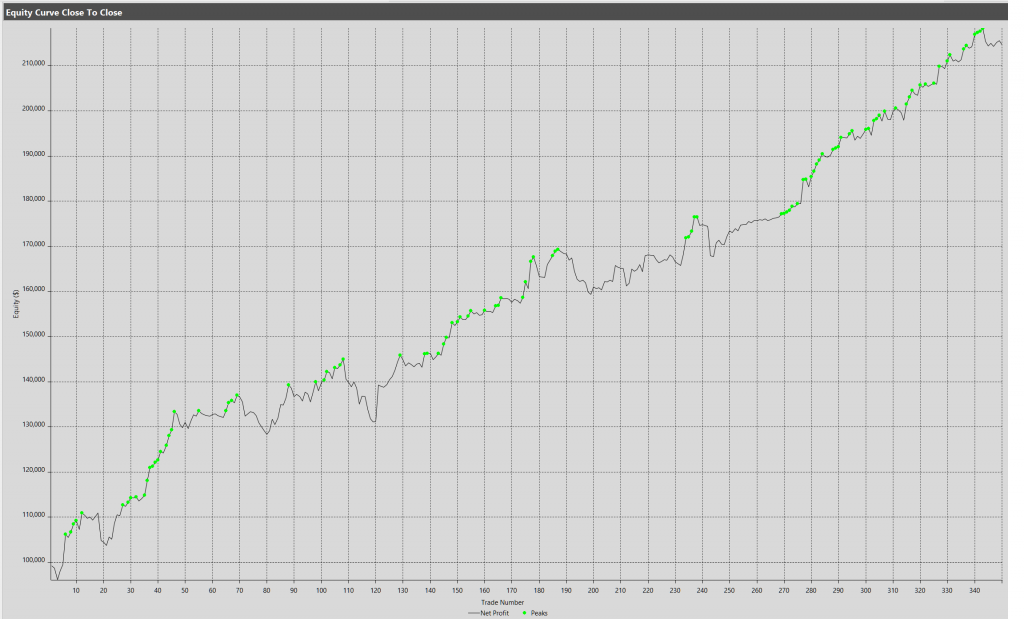

Crude Oil (@CL) technical “CG” Strategy for 5-Minute Timeframe (Intraday)

Breakout strategy based on universal principle that works for many instruments, such as @CL here, and GBPUSD below with unmodified parameters (strategy is robust):